Payday Loans: Debt Trap by Design

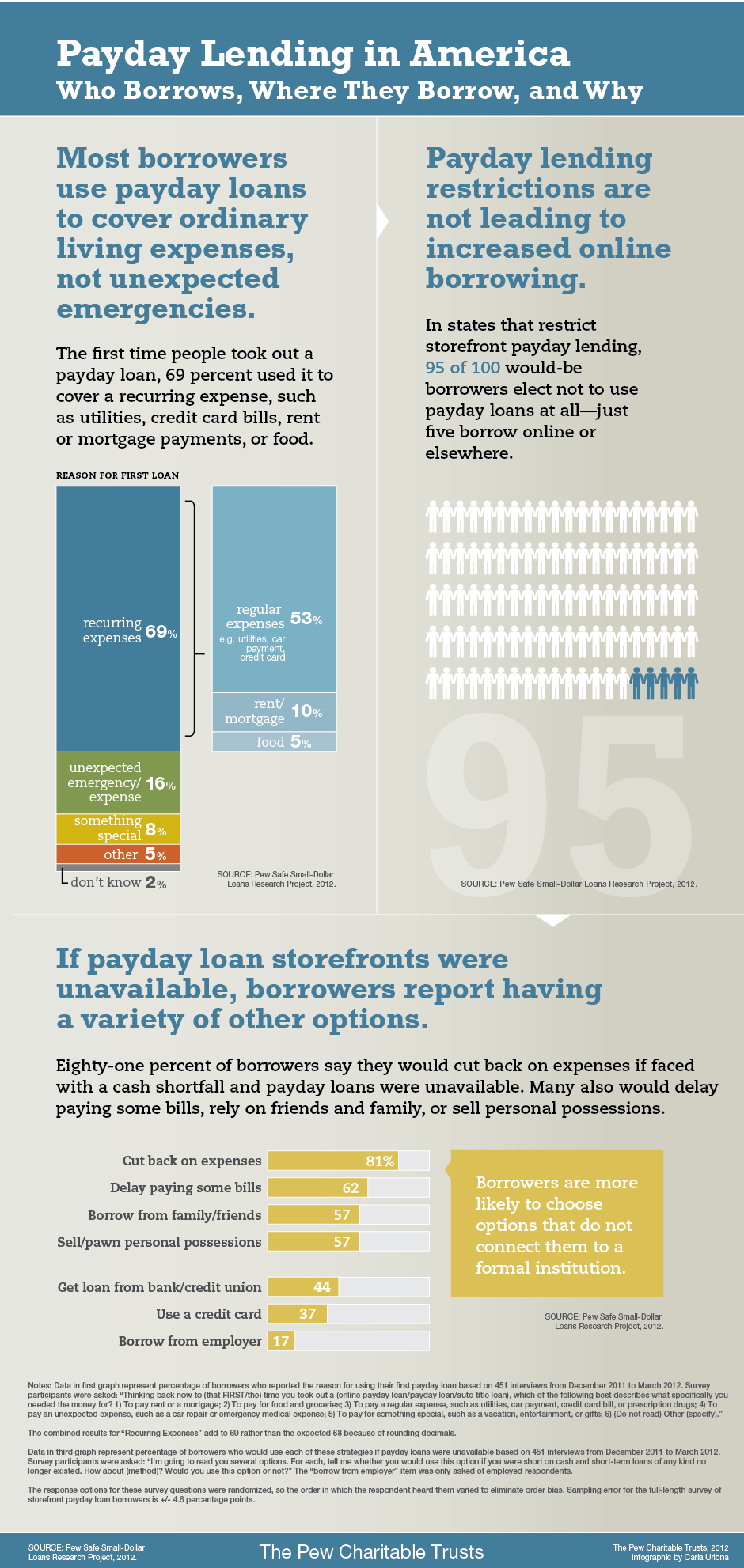

Payday loans are small-dollar, extremely high-cost loans. They are marketed as a one-time, “quick fix” for people facing a crash crunch. But the loan terms are designed to trap borrowers into long-term debt that causes a host of harms.

Traditional Balloon-Payment Payday Loans Traditionally, payday lenders have offered short-term payday loans: two week loans, with 300% interest rates, that are due in full on the borrower’s next payday. Borrowers are required to give the lender a post-dated check or electronic access to their bank account, so the payday lender gets paid back first on payday, leaving the borrower short on cash for other expenses. The borrower then returns to the payday lender to take out another loan, and the cycle of repeat borrowing continues, trapping the borrower in a long-term cycle of debt. In fact, payday lenders depend on the debt trap as the core of their business:

Long-term Payday Loans Increasingly, lenders are making long-term payday loans, which are just another debt-trap product. Payday lenders have migrated to these long-term loans to avoid regulations targeted at their traditional, balloon-payment payday loans. In a piece on payday lending for Last Week Tonight, comedian John Oliver described the situation as “legislative Whack-a-Mole.” He explained, "Just when you think you've squashed them, they pop up somewhere else, wearing a completely different outfit." These loans are like traditional payday loans on steroids: they often are in larger amounts and trap borrowers in high-cost debt even longer. They are structured to have multiple payments stretched over a longer period of time. Despite their installment terms, they carry the same predatory characteristics as balloon-payment payday loans, with the potential to be even more dangerous to borrowers. Long-term payday loans involve extremely high costs, generally over 200% with both fees and interest; lender access to the borrower’s bank account; repayments tied to payday; repeat refinancing; and high defaults. The loans remain profitable to payday lenders because they can collect more in fees than the principal loaned long before the end of the loan term. In other words, the lender profits and succeeds while the borrower fails. These long-term payday loans may carry even greater risk to borrowers than balloon-payment loans. A longer term loan increases the chances that a borrower, over the life of the loan, will experience loss of income or an unexpected expense that would lead to a default. And since, the loans are usually larger than traditional, two-week payday loans, it is even more difficult to eventually escape the debt without defaulting. Payday Loans Cause Financial Harm Payday loans were so harmful to the finances our service members that the Department of Defense found they were impairing military readiness. As a result, Congress passed and President George Bush signed a law establishing a 36% rate cap, including both fees and interest, for loans made to military members and their dependents. DOD initially applied the cap to loans of 90 days or less. Recognizing the harm caused by high-cost longer term loans, DOD recently modified its regulations to apply the 36% fees and interest rate cap to a broader range of consumer credit, including long-term payday loans. Long term financial harm associated with payday loans include:

Thankfully, Pennsylvania's strong laws effectively prevent these harms in the Commonwealth, and every effort must made to uphold existing protections. |

Strong Pennsylvania Law Protects

|