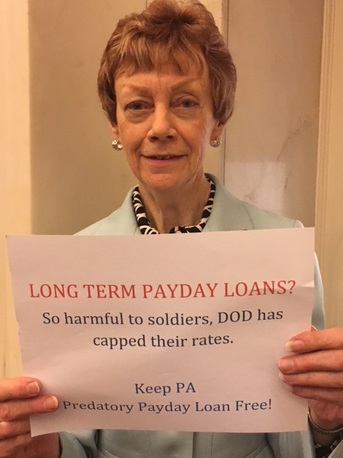

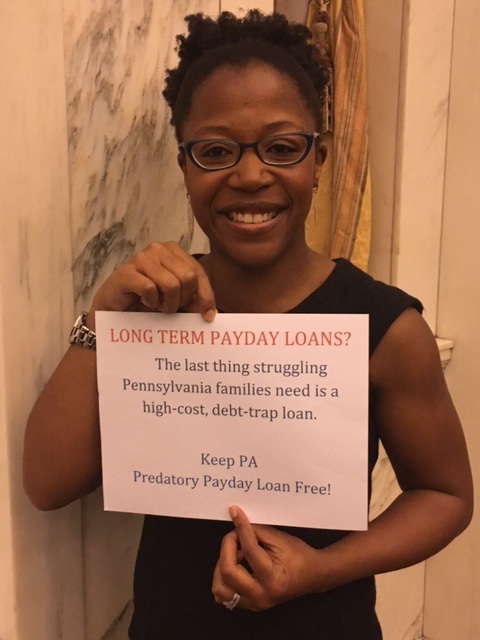

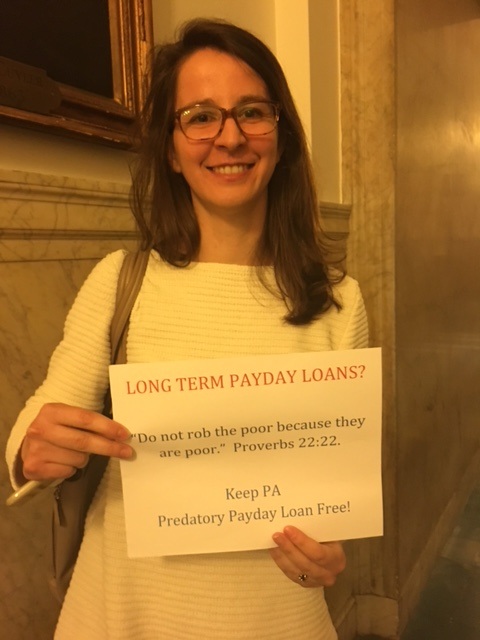

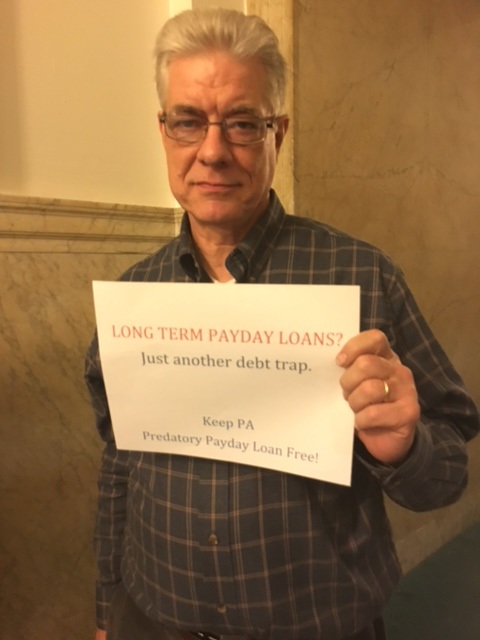

In advance of a forthcoming industry-backed bill to legalize high-cost, long-term payday loans in Pennsylvania, the Philadelphia City Council took the first step toward fending off their attempts by passing a resolution today, calling on members of the General Assembly to oppose any such legislation.

Members of the Coalition to Stop Payday Loans in Pennsylvania testified in favor of the resolution, applauding Philadelphia City Council for standing up for our most vulnerable, and thanking Councilwoman Cherelle L. Parker for her leadership on this issue.

The full press release is available below. Video available at this link.

RSS Feed

RSS Feed