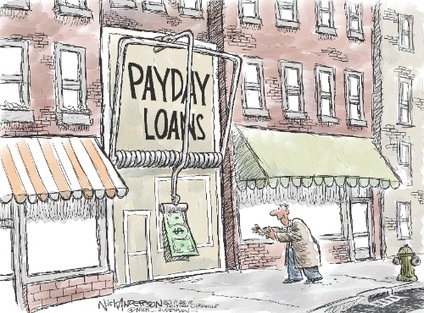

Right now, Pennsylvania's neighborhoods are free from payday loan storefronts that trap Pennsylvanians in a long-term cycle of debt.

As the new legislative session gets underway, out-of-state payday loan companies, and their high-paid lobbyists, are pushing hard to legalize 300% APR payday loans in our state.

Join us to help protect Pennsylvania's existing strong laws and prevent storefronts like these from flooding our communities.

As the new legislative session gets underway, out-of-state payday loan companies, and their high-paid lobbyists, are pushing hard to legalize 300% APR payday loans in our state.

Join us to help protect Pennsylvania's existing strong laws and prevent storefronts like these from flooding our communities.

RSS Feed

RSS Feed